Foreign Gift & Contract Reporting

The University of Denver is sustained by funding from several different sources, including, but not limited to, gifts, grants, and federal aid. To continue to receive funding from some of these sources, DU may have to comply with reporting requirements, including the reporting requirements set forth in Section 117 of the Higher Education Act (20 U.S.C. § 1011f).

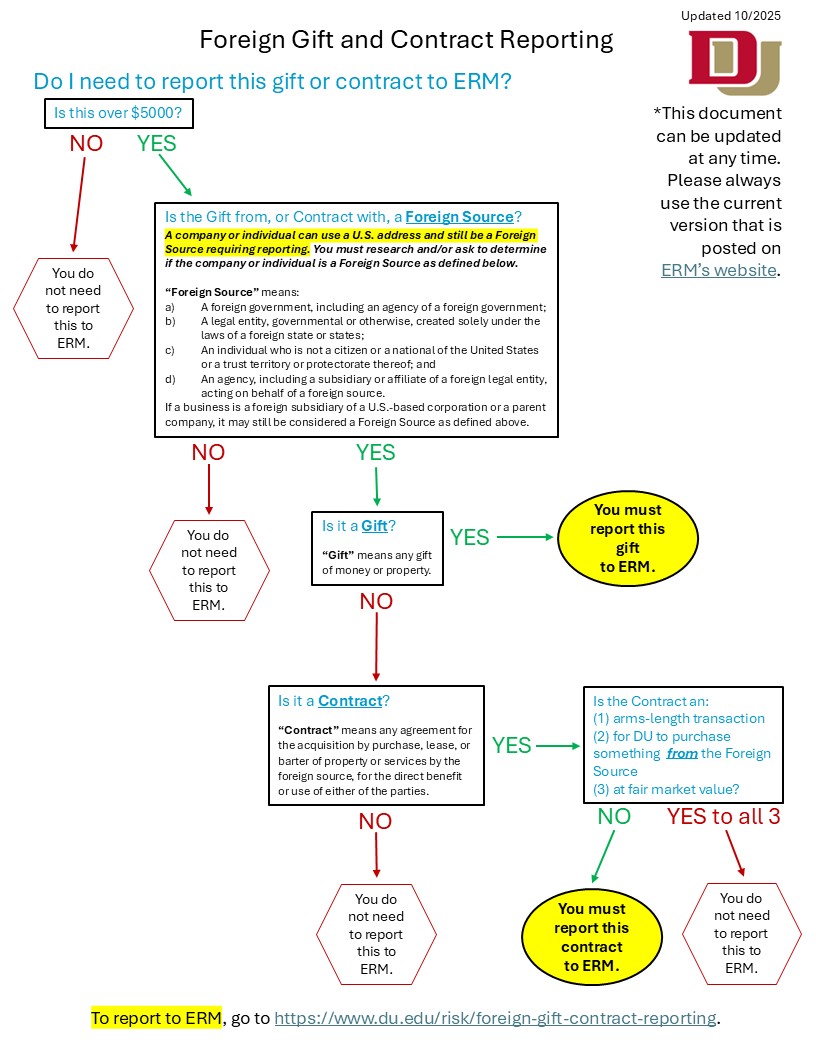

University units are required to internally report all Gifts from, and Contracts with, a Foreign Source that are valued at $5,000 or more to Enterprise Risk Management twice per year, no later than July 7 (covering the previous January 1 - June 30 period) and January 7 (covering the previous July 1 - December 31 period). To review DU's Foreign Gift and Contract Reporting Policy, please visit DU's Policy Library.